Irs pay estimated taxes online 2021

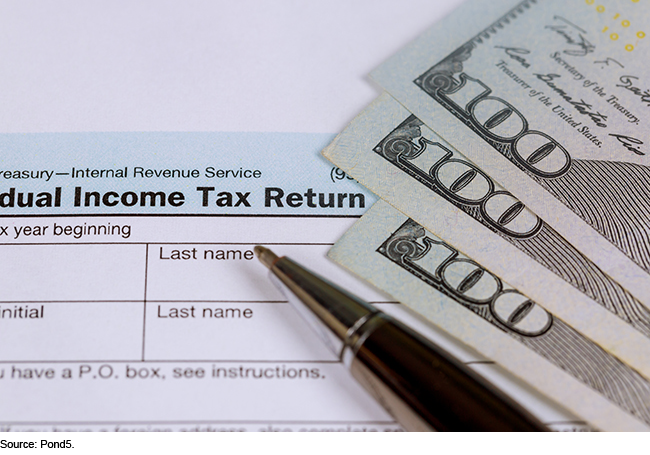

Make an Individual or Small Business Income Payment. These individuals can take credit only for the estimated tax payments that they made.

Irs Tax Payments Arrcpa

The final quarterly payment is due January 18 2022.

. Taxpayers can check out these forms for details on how to figure. Make joint estimated tax payments. If you dont pay.

Individual Payment Type options include. Make your check or money order payable to the DC Treasurer and write your Social Security number daytime. The deadline to file and pay your 2021 estimated taxes has passed.

Ad Use Our Free Powerful Software to Estimate Your Taxes. Crediting an overpayment on your. See What Credits and Deductions Apply to You.

2 They may file the income tax return and pay the tax in full on or before March 1 of the year following the tax year. If your employer did not withhold enough taxes and you are required to make estimated payments you must make one on or before January 15 2021. Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers.

By Patrick Thomas Last. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Quarterly tax payments should be made four times per year and the IRS does have guidelines or deadlines for these timeframes.

As a partner you can pay the estimated tax by. State taxes for California where I live can be paid. Enter Your Tax Information.

Pay IRS Taxes Online Guide Benefits 2021-22. Personal Income Tax Payment. Realty Transfer Tax Payment.

If income will be greater or less than. These were as follows for 2021 Taxes these. Web Pay Make a payment online or schedule a future payment up to one year in advance go to ftbcagovpay for more.

Tom Wolf Governor C. If you would like to make an estimated income tax payment you can make your payment directly on our website or use approved tax preparation software. You cant pay your 2021 taxes online until after this date.

IR-2022-77 April 6 2022. You can pay all of your estimated tax by April. The last day to pay is June 15th.

An estimated payment worksheet is. How do I pay my 2021 estimated taxes online. The final two deadlines for paying 2021 estimated payments are September 15 2021 and January 15 2022.

WASHINGTON The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals retirees investors. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Pay Irs Taxes Online Taxes are the biggest source so farming for any government in the world. In 2021 estimated taxes are due on April 15 June 15 September 15. To remit payment fill in and download the D-40P Payment Voucher.

You must pay at least 90 of your tax liability during the year by having income tax withheld andor making timely payments of estimated tax.

Pin On Form W 8 Ben E

Irs Offers Multiple Ways To Pay

Irs Tax Notices Explained Landmark Tax Group

Tas Tax Tip Paying The Irs Tas

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

How To Pay Your Estimated Taxes Online With The Irs Quarterly Taxes Youtube

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Tax Payments Arrcpa

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

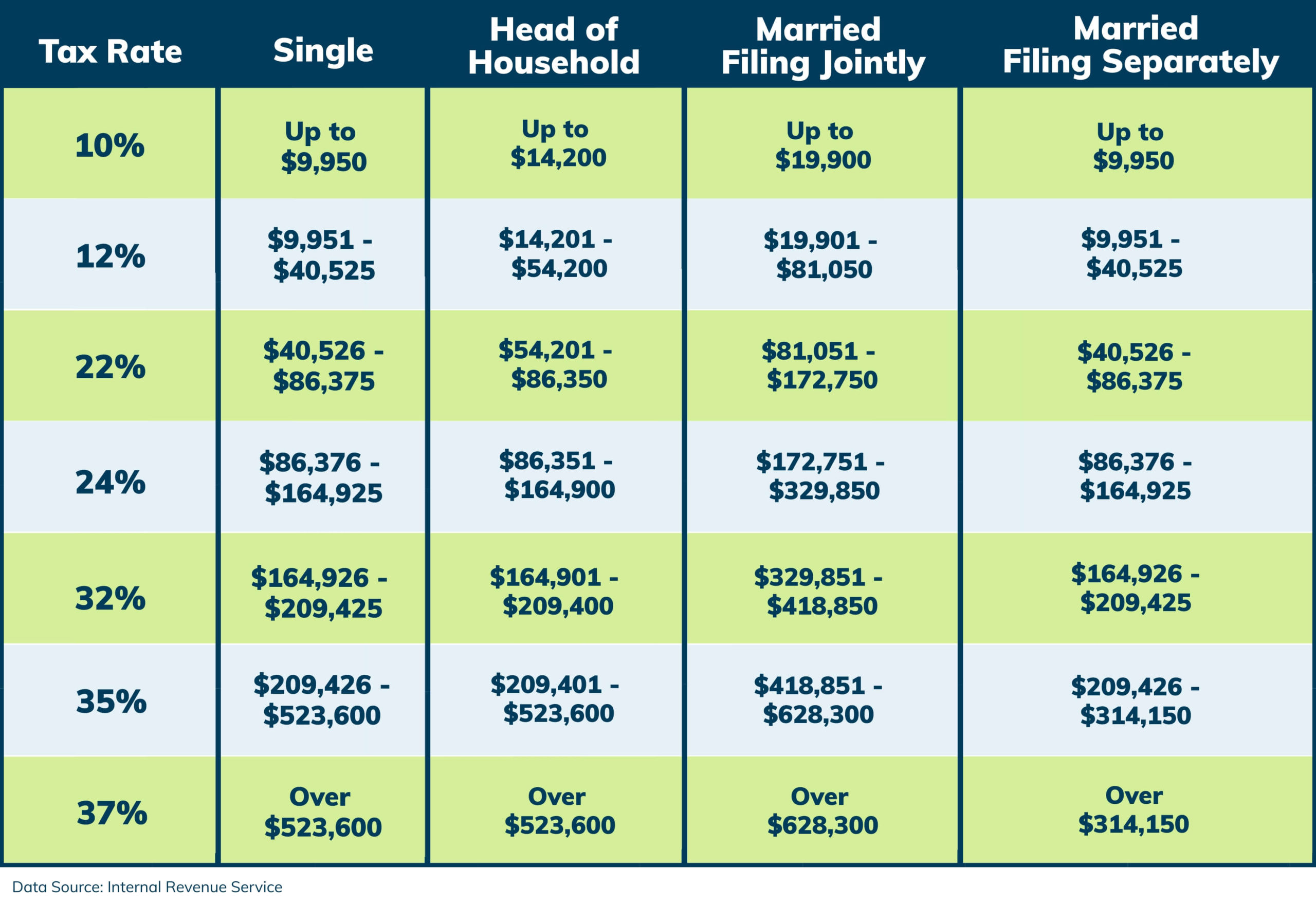

2021 Tax Changes And Tax Brackets

Estimated Tax Payments Youtube

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

How To Pay The Irs Online Pay Income Taxes Pay The Irs Taxes Online By Mail Pay 1040 Online Youtube